Want to End Chargebacks?

Get 3-D Secure!

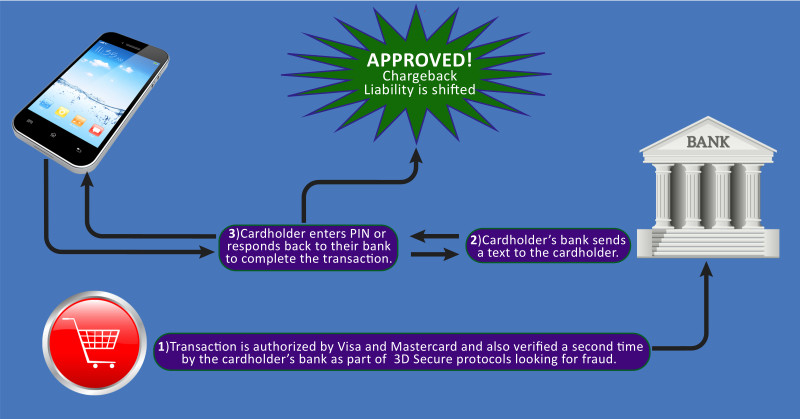

3-D Secure Liability Shift

The card holder’s bank provides and extra authentication of the card holder’s transaction and then if a transaction is suspicious it send a 2 factor authentication via text. When this happens, the card holder must respond to the text, or the transaction fails. The 2 factor authentication is determined by the card holder’s bank, but if any transaction is approved while using the 3d secure process, that transaction’s liability is shift from the merchant to the card holder’s bank.

Chargeback codes covered by 3-D Secure

A successful 3-D Secure transaction is protected against the following CNP chargeback codes:

| Card | Code | Reason |

|---|---|---|

| Visa | 10.4 | Other fraud—Card absent environment |

| MC | 4837 | No cardholder authorization |

| 4863 | Cardholder does not recognize—Potential fraud |

Liability Shift Conditions

The Electronic Commerce Indicator (ECI) Indicates the result of the authentication:

| ECI for Visa | ECI for MC | Description | Result |

|---|---|---|---|

| 5 | 2 | Cardholder was authenticated by the issuer with the cardholders identity information. | Liability Shift |

| 6 | 1 | Merchant attempted to authenticate cardholder, either cardholder or issuer was not participating. | Liability Shift |

| 7 | 0 | Payment transaction is conducted over a secure channel, but payment authentication is not performed. | No Liability Shift |